The American Customer Satisfaction Index (ACSI): Quarter 4, 2025

Pent-Up Customer Defection Compounds

- Customer satisfaction is flat and that’s a warning sign.

The national ACSI score remains where it was close to a decade ago, signaling long-term weakening of buyer utility even as companies report strong profits. - A wave of “pent-up customer defection” is building.

Stagnant satisfaction, rising complaints, and higher switching costs are creating a stockpile of latent churn that can release suddenly when barriers drop. - Market concentration is masking real economic fragility.

With fewer competitors and greater pricing power, firms can raise prices without improving the customer experience, a pattern that historically precedes slower GDP growth and rising inflation.

The U.S. economy faces a witches’ brew of destructive macro and microeconomic problems: increasing customer switching costs and complaints, with stagnating satisfaction. Paradoxically, customer defections are down – not up. These are not signs of a healthy economy.

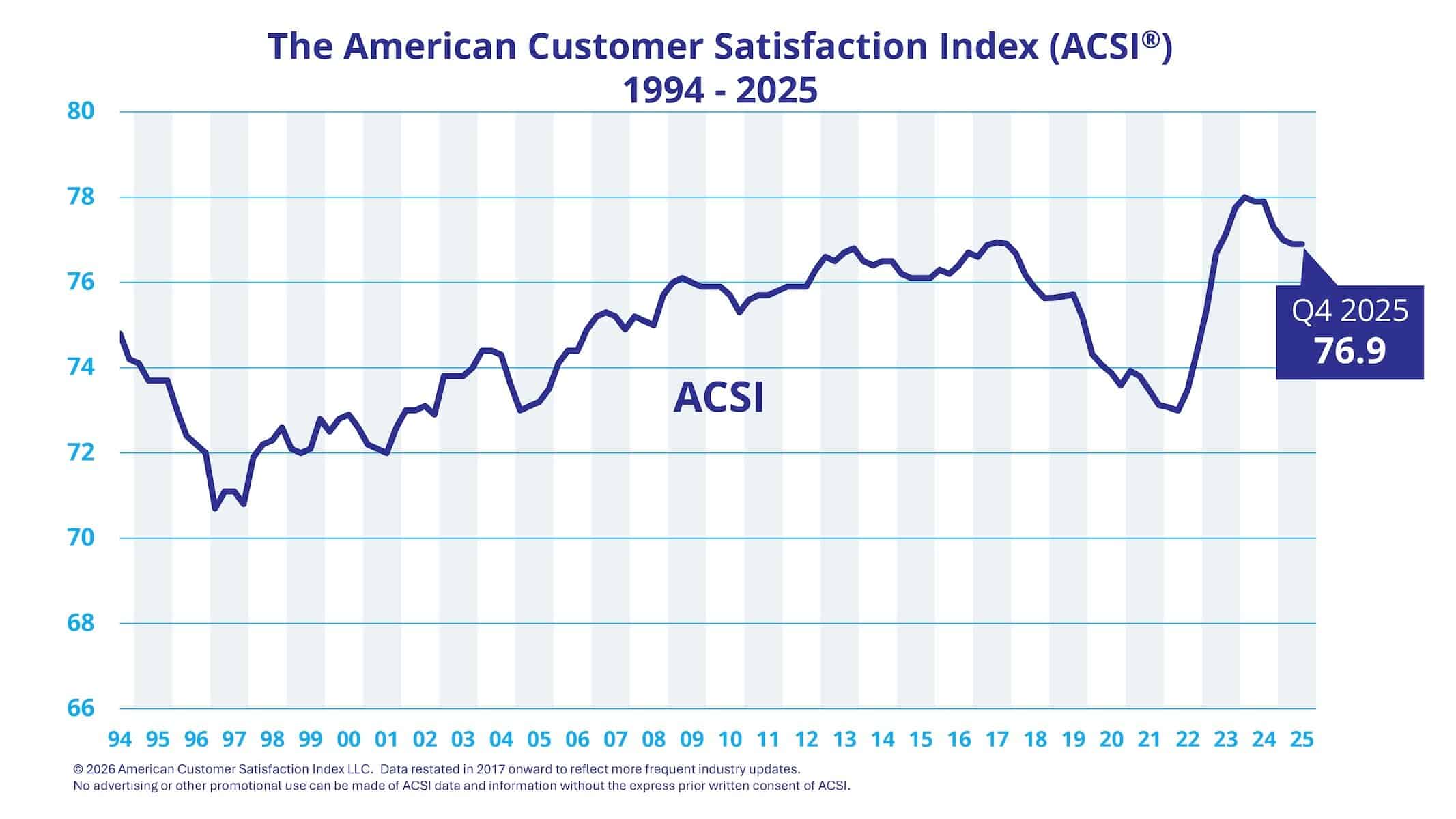

Over the past six months, the American Customer Satisfaction Index (ACSI®) is unchanged – even at the first decimal. From a sample of about 200,000 customers, the national ACSI score holds at 76.9 (out of 100) for the fourth quarter of 2025. On an annual basis, the Index fell by 0.5% and has not materially increased since 2017.

At the macro level, compounding market concentration, increasing seller pricing power, and higher buyer switching costs are major causes for the lack of improvement. At the micro level, irrelevant performance metrics and data-discordant analytics have made resource allocation for strengthening customer relationships next to impossible.

In well-functioning markets, buyer satisfaction and seller profits move together. When seller profits increase without a corresponding rise in buyer utility, it is an indicator of market inefficiency. Decoupling seller profit from buyer satisfaction impedes economic growth and slows innovation. Buyer surplus stagnates and inflation accelerates. Escalating M&A activity, without a corresponding increase in antitrust enforcement, has compounded the problem. Tariffs have had a similar effect by discouraging international competition.

The 1946-1948 World War II aftermath, the 2007-2009 Great Recession, and the COVID-19 pandemic’s shock to supply chains provide warnings, some of which apply today. Sellers took advantage of limited competition and raised prices.

During COVID-19, profit margins soared while customer satisfaction fell. The Great Recession of 2007-2009 was similar in some respects – it separated quantity of economic output (GDP) from quality of economic output (ACSI). Subsequently, cumulative GDP growth (post-2007) slowed by 13.5% – about $5 trillion in today’s money. Profits began to account for more of national income and also increased more than consumer spending did.

As to microeconomic consequences and corporate management concerns, pent-up customer defection is of increasing concern for managers, as well as shareholders. It represents the unrealized customer churn that accumulates over time, preceded by weak or stagnant customer satisfaction, increasing customer complaints, and higher customer switching costs. It is facilitated by contracts, lock-ins, market concentration, subscriptions, lack of substitutes, and consumer risk aversion.

Pent-up customer defection is a stock of covert risk – it is not a flow – and when released, it moves rapidly. It might be avoided, or its effect may be tamed, if corporations include more financial, accounting, and analytical expertise in building strong customer relationships. Strong customer relationships are important, albeit intangible, financial assets in a competitive marketplace and would benefit if managed as such. History is clear as to what will happen to firms that do not create strong customer relationships based on profit for the seller and satisfaction/utility for the buyer. They tend to occupy the bottom of the ACSI roster.

Strong customer relationships in competitive markets are critical for customer retention. Higher retention, in turn, has compounding multiplicative effects – and at high levels of retention, exponentially increasing effects – on revenue growth and profit, while simultaneously reducing uncertainty and cash flow instability.

Claes Fornell, the Donald C. Cook Distinguished Professor of Business (Emeritus) at the University of Michigan is the primary author of this press release. He led the development of the American Customer Satisfaction Index with assistance from Eugene W. Anderson, University of Pittsburgh; Michael D. Johnson, Cornell University; Birger Wernerfelt, M.I.T.; and David F. Larcker, Stanford University.

According to Google Scholar, Professor Fornell is the most cited person in the world on customer satisfaction and one of the most cited econometricians/statisticians with respect to structural equation models with unobservable variables and measurement error. He holds honorary doctorates from several universities.

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | |

|---|---|---|---|---|

| 2025 | 77.0 | 76.9 | 76.9 | 76.9 |

| 2024 | 78.0 | 77.9 | 77.9 | 77.3 |

| 2023 | 75.4 | 76.7 | 77.1 | 77.8 |

| 2022 | 73.1 | 73.0 | 73.5 | 74.4 |

| 2021 | 73.9 | 73.8 | 73.5 | 73.1 |

| 2020 | 74.3 | 74.1 | 73.9 | 73.6 |

| 2019 | 75.6 | 75.7 | 75.7 | 75.2 |

| 2018 | 76.7 | 76.2 | 75.9 | 75.6 |

| 2017 | 76.6 | 76.9 | 76.9 | 76.9 |

| 2016 | 76.3 | 76.2 | 76.4 | 76.7 |

| 2015 | 76.2 | 76.1 | 76.1 | 76.1 |

| 2014 | 76.5 | 76.4 | 76.5 | 76.5 |

| 2013 | 76.6 | 76.5 | 76.7 | 76.8 |

| 2012 | 75.9 | 75.9 | 75.9 | 76.3 |

| 2011 | 75.6 | 75.7 | 75.7 | 75.8 |

| 2010 | 75.9 | 75.9 | 75.7 | 75.3 |

| 2009 | 76.0 | 76.1 | 76.0 | 75.9 |

| 2008 | 75.2 | 75.1 | 75.0 | 75.7 |

| 2007 | 75.2 | 75.3 | 75.2 | 74.9 |

| 2006 | 74.1 | 74.4 | 74.4 | 74.9 |

| 2005 | 73.0 | 73.1 | 73.2 | 73.5 |

| 2004 | 74.4 | 74.4 | 74.3 | 73.6 |

| 2003 | 73.8 | 73.8 | 73.8 | 74.0 |

| 2002 | 73.0 | 73.0 | 73.1 | 72.9 |

| 2001 | 72.2 | 72.1 | 72.0 | 72.6 |

| 2000 | 72.5 | 72.8 | 72.9 | 72.6 |

| 1999 | 72.1 | 72.0 | 72.1 | 72.8 |

| 1998 | 71.9 | 72.2 | 72.3 | 72.6 |

| 1997 | 70.7 | 71.1 | 71.1 | 70.8 |

| 1996 | 73.0 | 72.4 | 72.2 | 72.0 |

| 1995 | 74.1 | 73.7 | 73.7 | 73.7 |

| 1994 | – | – | 74.8* | 74.2 |

*Baseline measurement taken in summer 1994

While companies today have more data about their customers, the analytics employed to turn data into information are for the most part not good enough. Customer satisfaction data have certain characteristics that make it difficult to obtain accurate estimates, to pinpoint what aspects of the customer experience need attention, and to gauge the financial impact of actions contemplated. Traditional statistical methods assume normal frequency distributions among the residuals, moderate multicollinearity, and low levels of data noise. Customer satisfaction data don’t meet these assumptions.

ACSI Analytics is designed to overcome these problems and thereby turning raw data into financially relevant information by:

- Separating signals from noise

- Moving from correlations and artificial intelligence (AI) patterns to cause-and-effect interpretations

- Calibrating measurement instruments toward profitability

Data is not the same as information—especially not data from consumer surveys. Management decisions require information; raw data must be filtered in order to be useful for decision-making. ACSI technology filters out data noise.

Management decisions require cause-and-effect information—something that current CX tools, whether based on AI or descriptive statistics, don’t provide. ACSI Analytics, on the other hand, is based on a causal model.

There is a wide disparity in the amount of consumer data collected by companies today. Some data suppliers use surveys with more than 200 questions per respondent, while others focus on responses to a single question. Neither is appropriate. Excessively long surveys may lead to straight-line responses. Good measurement techniques—whether in the social or physical sciences—typically require several measures (survey questions in this case) per product feature or service dimension.

Accuracy and relevance are what matters. To contribute to the business objectives at hand, the measurement instruments need calibration in ways similar to the physical sciences. This is why companies with high scores in the American Customer Satisfaction Index, which is calibrated to maximize customer loyalty, are financially successful, most notably in terms of stock returns and profitability.

No advertising or other promotional use can be made of ACSI data and information without the express prior written consent of ACSI LLC.